lake county real estate taxes illinois

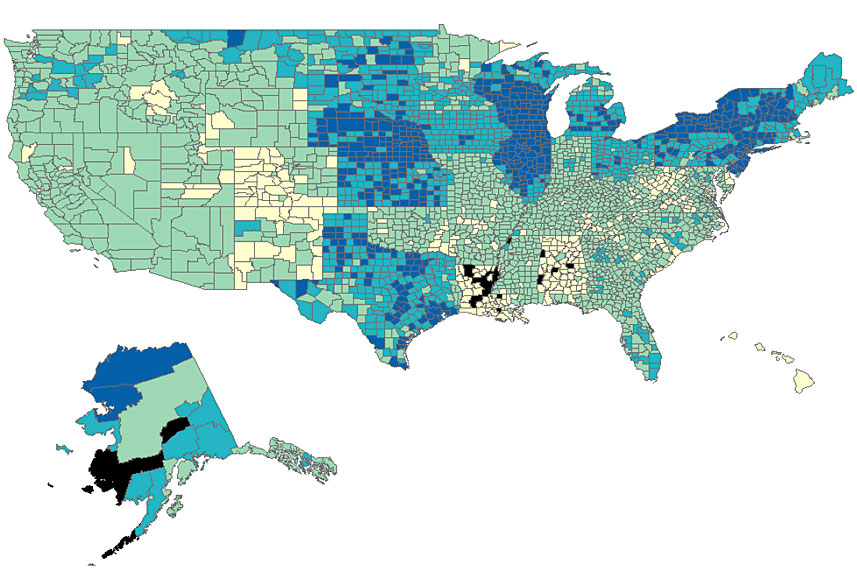

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on. Lake County has one of the highest median property taxes in the United States and is ranked 15th of the 3143 counties in order of median.

Illinois Now Has The Second Highest Property Taxes In The Nation Chicago Magazine

The County Clerks office administers the redemption process.

. 847-377-2000 Contact Us Parking and Directions. With an average tax rate of 216 Lake County Illinois collects an average of 6285 a year per resident in property taxes. Last day to pay to avoid Publication and Final Notices by 500pm.

Property Tax Change-of-Name Form Enter the 10 digit Property Index Number PIN with or without dashes for the property. Ad valorem is a Latin phrase meaning according to worth. The median property tax on a 28730000 house is 301665 in the United States.

Wednesday July 20 2022 Last Day of Payment of 2nd Half of 2021 Taxes. Discover Lake County Illinois Real Estate Taxes for getting more useful information about real estate apartment mortgages near you. Select Tax Year on.

Lake County collects on average 219 of a propertys assessed fair market value as property tax. Ad Find Out the Market Value of Any Property and Past Sale Prices. Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022.

2021 Taxes Payable in 2022. Lake County Jobs. My staff is dedicated to providing information you need to make informed decisions in a clear and transparent manner.

We perform a vital service for Lake Countys government and residents and Im honored to serve as your Treasurer. Lake County Jobs. 4233 OLD GRAND AVE.

Last day to submit changes for ACH withdrawals for the 2nd installment. The median property tax on a 28730000 house is 629187 in Lake County. The exact property tax levied depends on the county in Illinois the property is located in.

Lake County collects the highest property tax in Illinois levying an average of 628500 219 of median home value yearly in property taxes while Hardin County has the lowest property tax in the state collecting an average tax of 44700 071 of median home value per year. Yearly median tax in Lake County. Lake County IL 18 N County Street Waukegan IL 60085 Phone.

Any changes to the tax roll name address location assessed value must be processed through the Lake County Property Appraisers Office 352 253-2150. BENSON JR ROB ROY. If property taxes are not paid on time they become delinquent and sold at a tax sale.

Lake County collects on average 219 of a propertys assessed fair market value as property tax. Lake County homeowners last year paid higher property taxes averaging 9186 than any other Illinois county and the new bills are. 2021 Taxes Payable in 2022.

The median property tax on a 28730000 house is 497029 in Illinois. Once the Department has certified the final equalization factor County Clerk applies the factor to the final assess value determined by Assessor and modified by the. Lake County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

I welcome your comments and ideas on how we may continue to improve our. As your Lake County Property Appraiser Im working to improve this site with information important to Lake County home and business owners. Notice Of Real Estate Tax Due Dates.

Wednesday February 16 2022 Last Day of Payment of 1st Half of 2021 Taxes. The median property tax in Lake County Illinois is 6285 per year for a home worth the median value of 287300. The median property tax in Lake County Illinois is 6285 per year for a home worth the median value of 287300.

Those sold taxes must be repaid redeemed in order for the current owner not to lose ownership of the property. 151 E LAUREL AVE UNIT 104. Maps Records Transparency.

2021 Real Estate Tax Calendar payable in 2022 Last day to submit changes for ACH withdrawals for the 1st installment. Ad valorem taxes are levied on real estate property and are based on the assessed value of the. 847-377-2000 Contact Us Parking and Directions.

Lake County IL 18 N County Street Waukegan IL 60085 Phone. After clicking the button the status will be displayed below. Current Real Estate Tax.

The median property tax also known as real estate tax in Lake County is 628500 per year based on a median home value of 28730000 and a median effective property tax rate of 219 of property value. Select Tax Year on the right. The Illinois Department of Revenue is required by law to calculate tax equalization factor often called multiplier to achieve uniform property assessment throughout the state.

Lake County ranks 18th of the 3143 counties for property taxes as a percentage of median income making property taxes in this area notably higher than both the state and national averages. Maps Records Transparency. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

Last day to pay online to avoid Publication and Final Notices. Ill be making sure the office carries out its required duties and becomes a place where Lake County residents can get answers.

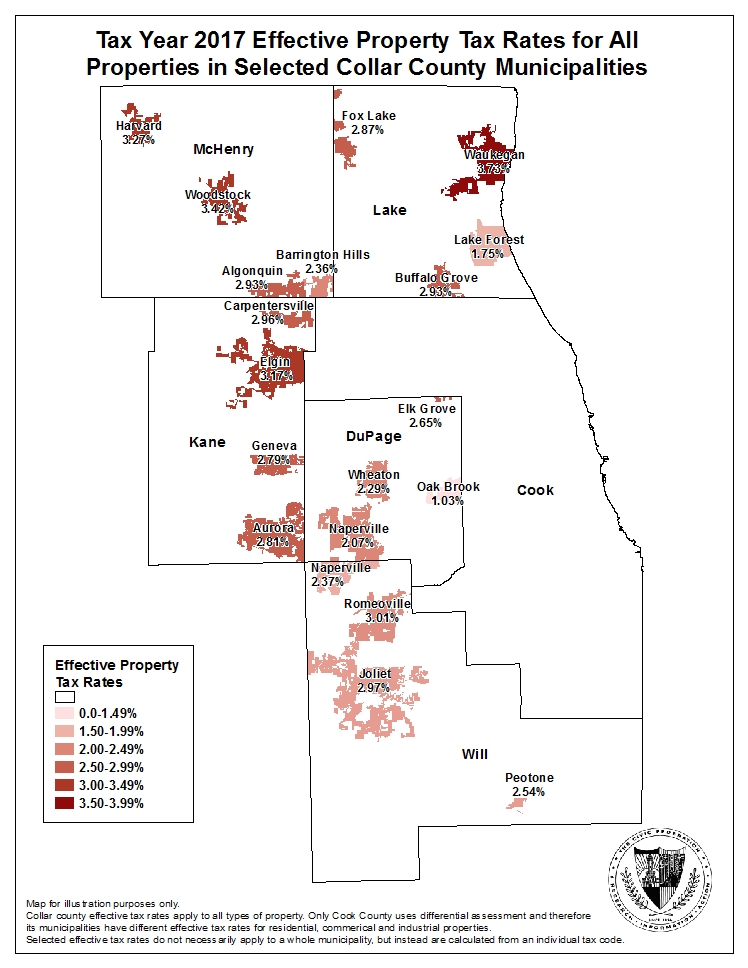

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Pin On Illinois Horse Properties

Will County Real Estate Property Taxes Video In 2022 Real County Property Tax

The Villa Turicum Blog The Last Days Of 1000 Lake Shore Drive 1952 Lake Shore Drive American Castles Chicago Architecture

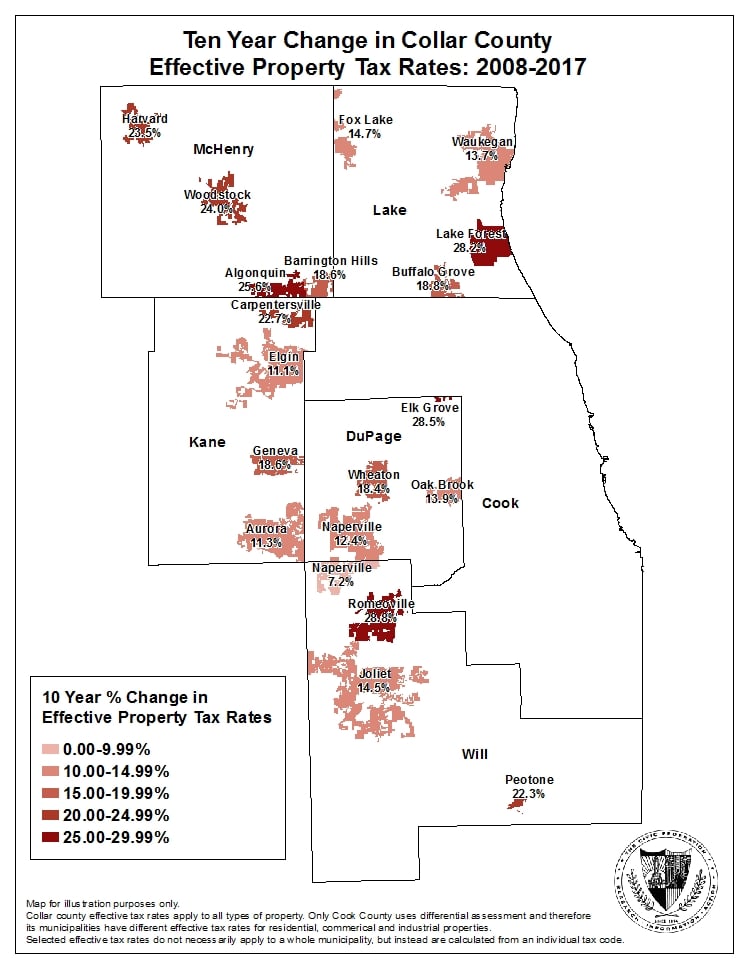

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Kentucky Property Taxes The Homestead Exemption For Owensboro Ky Property Owners Tony Clark Real Estate Owensboro Kentuc In 2021 Owensboro Kentucky Property Tax

Cook County Board Of Review Residential Property Tax Appeals Period Open Until February 1 2022

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

The Best School Districts In Illinois In 2014 As Ranked By Schooldigger Http Www Disclosurenewsonline Com 2015 01 25 Th School Fun School District Illinois

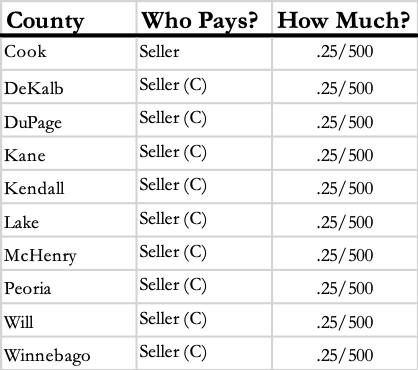

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Google Image Result For Http Www Appraisercitywide Com Xsites Appraisers Appraisercitywide Content Uploadedfiles Zi Homeowners Guide Illinois Chicago Suburbs

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

The Cook County Property Tax System Cook County Assessor S Office Property Tax County New Trier

Lake County Assessors Clash Over Property Value Hikes Lake County Property Values Lake

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Property Taxes In The State Of Illinois Are Billed The Following Year Of The Tax Period For Instance Property Ta Chicago Real Estate Estate Law Estate Lawyer